Whole Life Insurance Louisville Fundamentals Explained

Table of ContentsThe Buzz on American Income LifeTerm Life Insurance Can Be Fun For AnyoneGetting My American Income Life To Work8 Easy Facts About Life Insurance Louisville Ky Shown5 Simple Techniques For Senior Whole Life InsuranceThe Definitive Guide to Senior Whole Life InsuranceEverything about Child Whole Life InsuranceHow Life Insurance Quote Online can Save You Time, Stress, and Money.The Buzz on Cancer Life Insurance

The franchise business contract calls for that he directly agreement for "all required insurance policy" for the effective procedure of the franchise. He anticipates to have twelve staff members, 5 full time and seven part-time (the shipment people), at his place, which will be on a hectic boulevard in Lubbock and will provide take-out just.What sort of insurance policy will be "necessary"?. Whole life insurance Louisville.

Rumored Buzz on Life Insurance Companies Near Me

There are various sorts of Marketplace medical insurance plans created to meet different demands. Some kinds of strategies limit your provider choices or encourage you to obtain care from the strategy's network of doctors, medical facilities, pharmacies, as well as other clinical provider. Others pay a greater share of expenses for service providers outside the plan's network.

Some instances of plan types you'll locate in the Market: A managed treatment plan where services are covered just if you utilize doctors, specialists, or medical facilities in the strategy's network (except in an emergency). A kind of medical insurance strategy that typically limits coverage to care from physicians who help or contract with the HMO.

Whole Life Insurance - Truths

An HMO may need you to live or operate in its service location to be qualified for insurance coverage. HMOs often supply integrated treatment as well as focus on prevention and also wellness. A sort of plan where you pay less if you use medical professionals, medical facilities, and also various other health care providers that belong to the plan's network.

A kind of health and wellness plan where you pay much less if you make use of carriers in the strategy's network. You can make use of medical professionals, hospitals, and also carriers outside of the network without a reference for an extra price.

9 Simple Techniques For Whole Life Insurance

While we typically can not stop the unforeseen from occurring, in some cases we can obtain some protection. Insurance policy is implied to guard us, a minimum of monetarily, must specific things happen. Yet there are many insurance alternatives, as well as several economists will certainly state you require to have them all. It can be challenging to determine what insurance coverage you actually require.

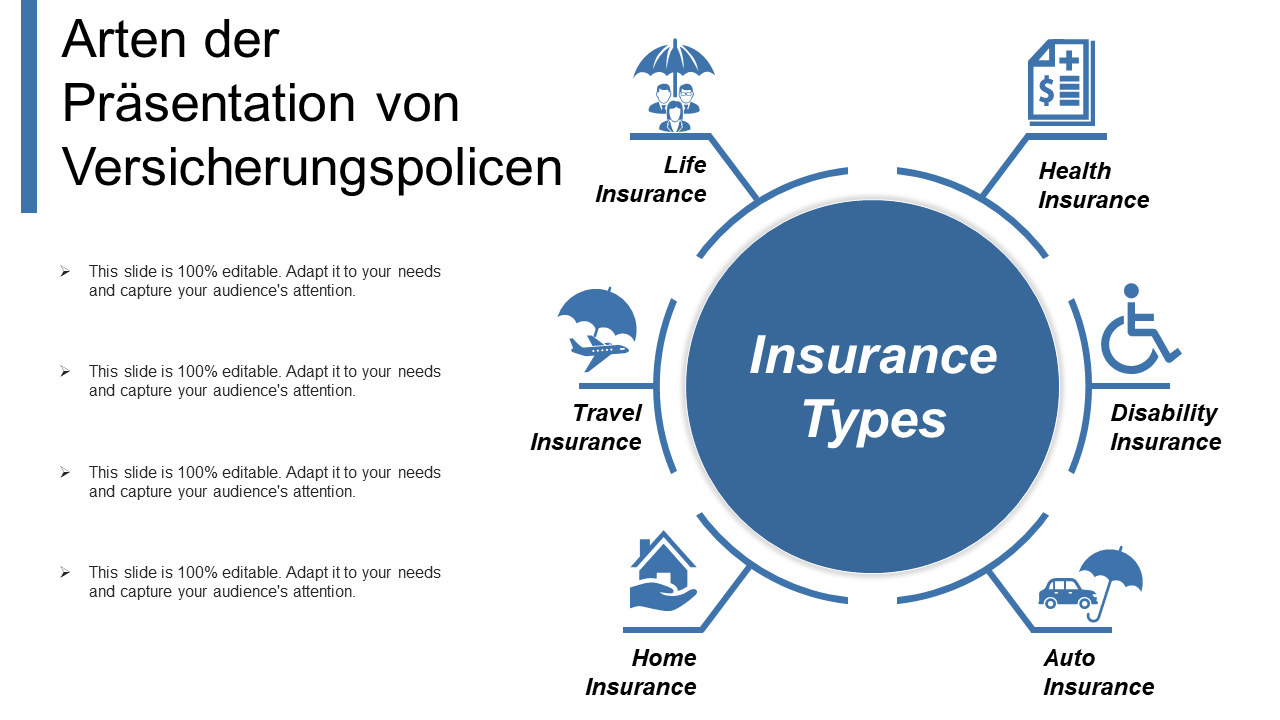

Elements such as kids, age, way of living, and also work benefits play a function when you're developing your insurance portfolio. There are, however, four types of insurance coverage that a lot of economic specialists advise we all have: life, wellness, auto, and long-term handicap.

Little Known Questions About Cancer Life Insurance.

Sector professionals suggest a life insurance policy that covers 10 times your annual revenue. That's a number not everybody can afford. When estimating the amount of life insurance policy protection you need, bear in mind to consider not only funeral costs, yet likewise everyday living expenses. These may include mortgage repayments, exceptional financings, credit scores card financial debt, tax obligations, youngster care, and also future college expenses.

The 2 basic types of life insurance policy are conventional entire life and term life. Just clarified, whole life can be utilized as a revenue tool along with an insurance coverage instrument. As long as you remain to pay the regular monthly costs, entire life covers you up until you pass away. Term life, on the other hand, is a plan that covers you for a collection amount of time.

Not known Details About Child Whole Life Insurance

, boosted deductibles, and went down protections, health insurance policy has actually come to be a luxury fewer and less individuals can afford. The best and least costly choice might be taking part in your company's insurance program, but lots of smaller sized services do not use this advantage.

6 Easy Facts About Life Insurance Company Explained

If you do not have medical insurance with an employer, get in touch with profession organizations or associations regarding possible group health and wellness protection. If that's not an alternative, you'll require to get exclusive health and wellness insurance. Long-Term Disability Coverage Lasting disability insurance coverage is the one sort of insurance policy many of us believe we will never ever need.

Commonly, also those workers who have great medical insurance, a good nest egg, and an excellent life insurance coverage policy do not prepare for the day when they could not have the ability to help weeks, months, or ever before once again. While medical insurance pays for a hospital stay as well as medical expenses, you're still left with those daily expenditures that your income generally covers.

The smart Trick of Child Whole Life Insurance That Nobody is Talking About

The expense of handicap insurance policy is based on numerous elements, including age, way of life, as well as health and wellness. Numerous strategies call for a three-month waiting period before protection kicks in, supply a maximum of three years' worth of protection, and also have some substantial policy exemptions.

How Life Insurance Company can Save You Time, Stress, and Money.

7 million automobile accidents in the united state in 2018, according to the National Freeway Web Traffic Safety Management. Whole life insurance Louisville. An estimated 38,800 people died in automobile accidents in 2019 alone. The top cause of fatality for Americans between the ages of five and 24 was auto accidents, according to 2018 CDC data.